Government driven prices rises on the menu from tomorrow

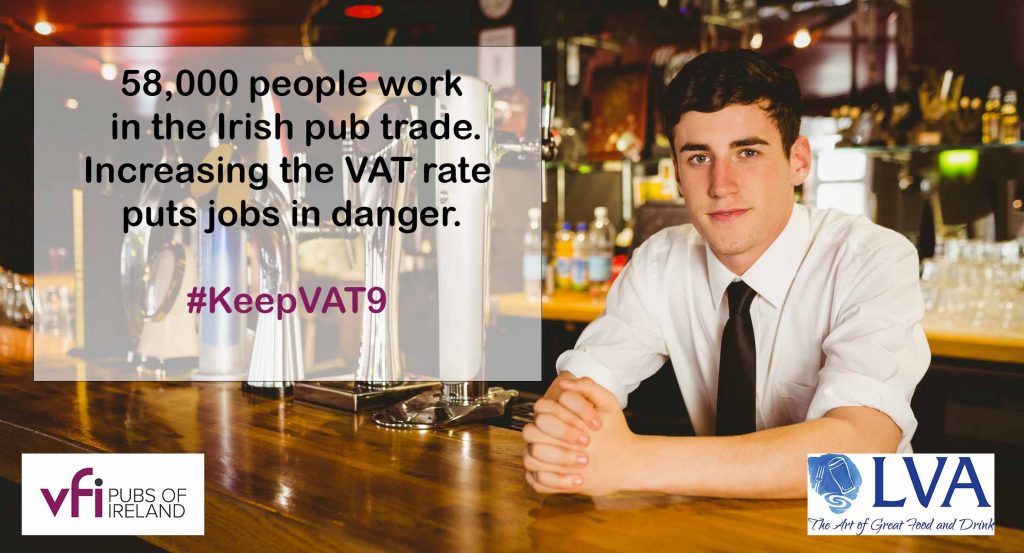

Government driven price rises will be on the menu for pubs and restaurants from tomorrow with the increased rate of hospitality VAT set to kick in, the Licensed Vintners Association (LVA) has warned. The LVA and other hospitality groups had been seeking a continuation of the current 9% VAT rate that applies on food but […]

Government driven prices rises on the menu from tomorrow Read More »